As mentioned in the post above, once you have your Notice Of Eligibility letter then there are two ways to receive a pension from the Reserves or Guard. One way is "retired awaiting pay", which almost everyone chooses. The High-Three pension calculation takes the average of the highest 36 months of pay.

For a Reserve or National Guard retirement the pension is typically calculated from the rank for which you met the time-in-grade requirement. The pay base for that pension is calculated from the average of the highest 36 months of pay in that rank using the pay tables in effect when you start that pension. So in your case you'll remain "retired awaiting pay" until your Reserve pension starts. If you were mobilized for at least 90 days to a combat zone then you might qualify for an earlier pension start date. Since you were mobilized in 2012, your combat zone deployment's 90-day periods would have to be within a fiscal year to count for an earlier pension start. If you have 180 days in a combat zone in one FY , then your Reserve pension would start six months earlier.

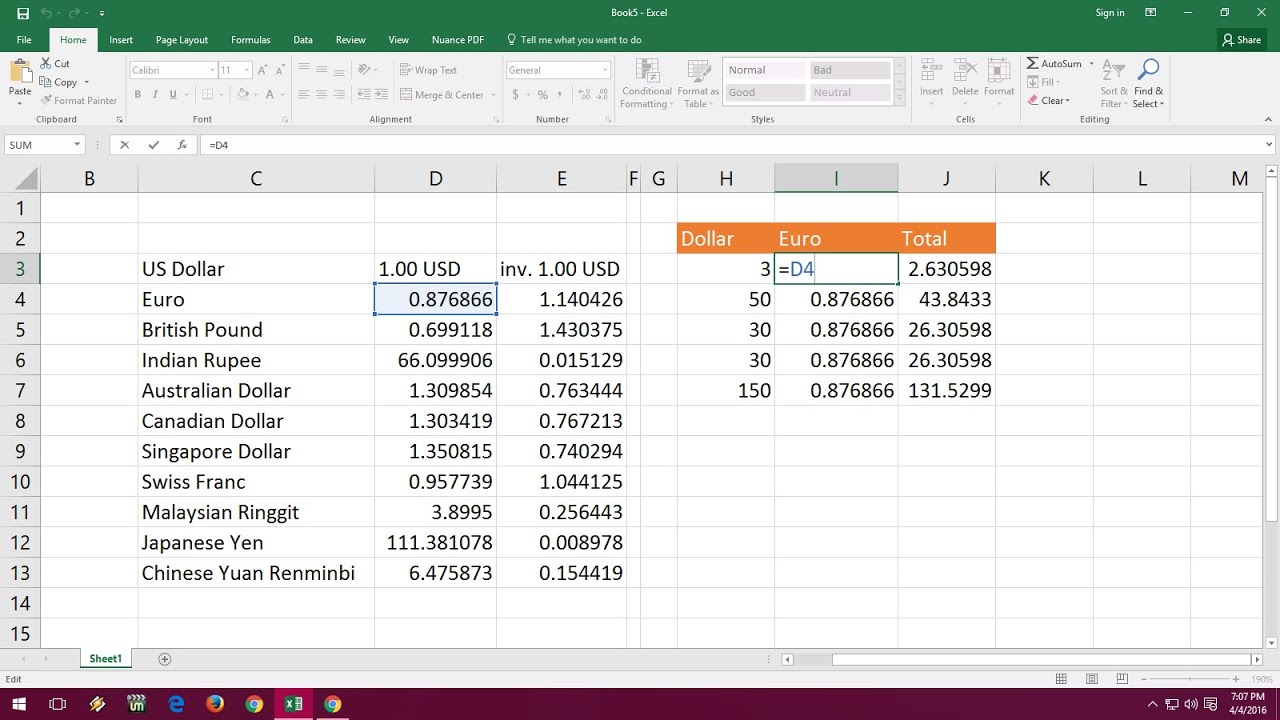

But if you have less than 90 days in a FY then that does not count. 120 days in one FY and 60 days in another FY would only start your pension three months sooner. This means that you have to serve three years' time in grade to retire at the rank of O-5 but you do not have to worry about MRD. You're simply continued in your "retired awaiting pay" status until you reach age 60. I'm not familiar with the website calculator you mention, but it probably does the math for your years of service and your age to forecast your pension at age 60. For a more relevant number you could calculate your pension in today's dollars with today's pay tables (using the longevity you'd have at age 60) and compare that directly to your current expenses.

By using today's dollars, you don't have to account for inflation. By retiring at MRD and immediately starting your Reserve O-5 pension , you had months of O-6 pay which were higher than your O-5 retirement rank. The Defense Finance and Accounting Service used the Tower Amendment to calculate the High-36 average to give you the higher pay base to use in the Reserve pension calculation. That's the average of the 18 months of O-6 pay and the 18 months of O-5 pay for the pay tables in effect at the time you started your pension. By federal law, the pension is calculated using the pay tables in effect during the month that you start your pension.

In other words, you'll be figuring out your High-Three average of the pay tables in effect at age 60 . You don't explicitly mention the date that you'll turn age 56, but I'm guessing that it's before your MRD of 21 August 2020. You'll have to calculate your own High Three average of the future pay tables that will be in effect when you reach age 60. If you want to do the calculation in today's dollars then just take roughly 96% of the latest pay tables for the maximum pay in your retirement rank. The problem with this calculation is that Reserve/Guard members who "retired awaiting pay" have to wait until they turn age 60 to know exactly what amounts are on that pay table. With our military time converter , you'll quickly find out what time it is in military time.

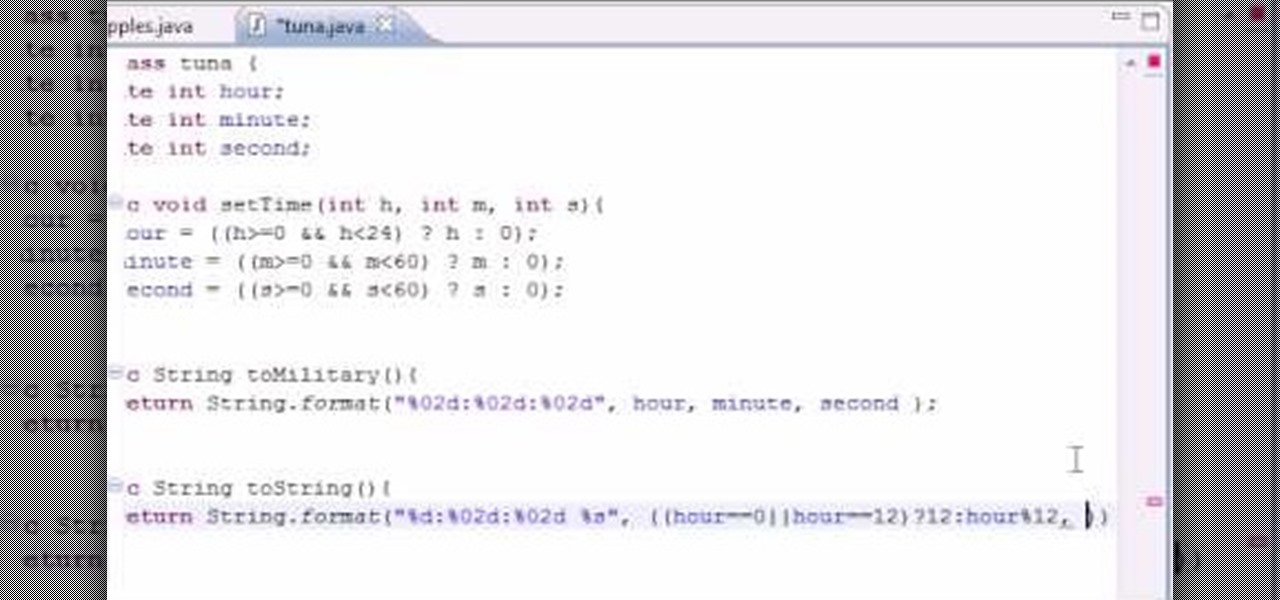

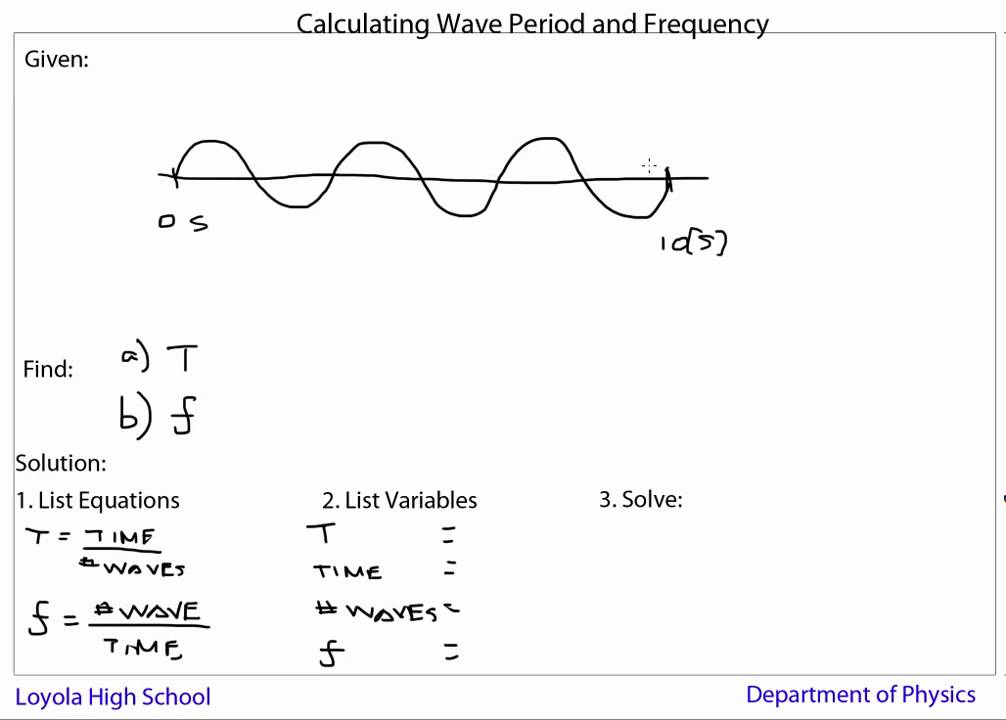

Not only can you convert military time to standard time and vice versa, but you can also check what is the military time right now. For you visual learners out there, we also present a comprehensive military time chart, along with a military time minutes chart. If you have a hard with reading military time, don't fret! We'll also explain to you just how to tell military time.

You could wait to start your Reserve pension on 1 January 2019, but it works against you with High Three. It can work with the Final Pay pension system (it's usually less than a 10-year payback), which is applicable to those who started active duty before 8 September 1980. However High Three averages the final 36 months of pay tables before you start your pension. Your pension will start three months earlier for every 90 days during a fiscal year that you spent deployed to support combat operations in accordance with the 2008 NDAA requirements. You already know that you have 90 days before 30 September 2010, and you probably have another three 90-day periods before the end of the deployment. You'll also have to check that your orders comply with the deployment requirement to support combat operations.

If your orders were written correctly then you'll be eligible to start your pension at age 59. As John says, the federal law for retired awaiting pay is "… as though the member had been on active duty the entire time" during gray area. For most ranks and ages it's the maximum longevity pay in that rank. However those who've joined the Reserves in their 30s might not reach the maximum pay for their rank by age 60. It's possible that you may see a status update in your MyPay account, although that depends on the timing of DFAS running the payroll/pension process around the 20th of the month.

Your first deposit will be paid retroactive to the early-retirement date that you're eligible to start your pension. Subsequent deposits will be the regular amount of your pension. Military time is a method of measuring the time based on the full 24 hours of the day rather than two groups of 12 hours indicated by AM and PM. Using military time is the standard method used to indicate time for medication administration. The use of military time reduces potential confusion that may be caused by using AM and PM and also avoids potential duplication when giving scheduled medications. For example, instead of stating medication is due at 7 AM and 7 PM, it is documented on the medication administration record as due at 0700 and 1900.

See Figure 5.5 for an example clock and Table 5.3 for a military time conversion chart. Finally, talk to a military lawyer who's familiar with Title X U.S. Code for military retirement law. You want to make sure that your retirement occurs as an O-3. It's also possible that your deployments after 28 January 2008 may make you eligible to start a Reserve retirement earlier than age 60. You need solid legal advice on both of these criteria before you can count on the numbers.

The first issue is the future pay tables that'll be in effect during the month you start your pension. We don't know what the pay tables will look like in 2019 or 2020 but 2% each year is a reasonable estimate on the current 2.6% legislative proposal. You could use those estimates to calculate the 36-month average of your O-5 base pay. I spent 11 years (1983 – 1994) in the active US Navy where I achieved the rank of CPO (E-7).

My discharge DD-214 shows E-7 as my discharge grade, my discharge was R-1 Honorable. I returned to service in the North Carolina Army National Guard at the rank of E-6. I was told that upon reaching retirement age my pay would be based on E-7 as this was my highest rank attained. I remained an E-6 throughout my 10 (1997 – 2007) years in the NCANG and retired at this grade.

I have my "20 year letter" and I have a little over 5100 points with the active Navy, reserve time and an activation in 2005 – 2006. I elected to "retire awaiting pay" as I saw that the financial upside was worth the possibility of being re-called. Otherwise if your DIEMS is after 7 September 1980 then your pension is High Three, calculated from the average of the highest 36 months of pay received during your career. (That's completely separate requirement from three years' time in grade.) For a Reserve pension you'd retire as an O-5 if you met the Title 10 U.S.

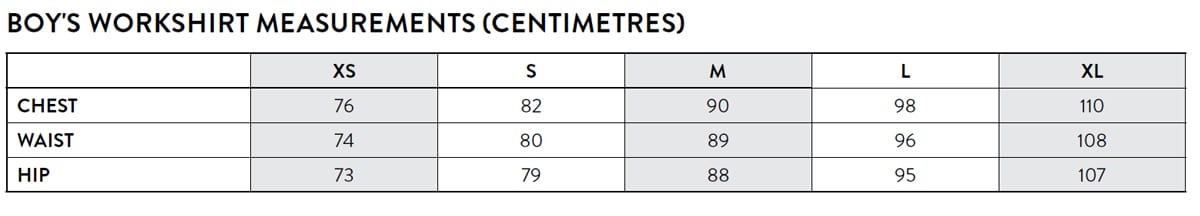

Code section 1370 requirements, and then the High Three calculation would determine the pay factor in your pension. If you did not meet those time-in-grade requirements then you'd be retired as an O-4. The military time conversion chart below lists the standard 12-hour time format next to the 24-hour time format. This is followed by military time, UTC offset , military time zone name and the time zone letter code. Your active-duty service counts toward good years.

If you review your point count summary online, you'll probably see a good year for every year of active duty plus another good year for your Army Reserve time. If that's the case then you only have 14 good years remaining until you're eligible for retirement. Your active-duty time also accrues a point for each day, so you probably received over 1800 points for those five years. Although Congress has authorized the Temporary Early Retirement Authority legislation through 2018, each service uses it at their own discretion. Your best option is to contact your service's personnel branch to determine their policy and to request TERA. However you may also qualify for a medical disability retirement.

The medical retirement will not have the pension reduction that's part of the TERA calculation, so you should see how the MEB process turns out before requesting TERA. You should also review the MEB and the TERA questions with a military lawyer. The JAG can help you verify that you're getting due process from the MEB and that you'll receive all the benefits to which you're entitled. First, your Date of Initial Entry on Military Service is after 8 September 1980 so your pension is High Three. Back in the days of the Final Pay dinosaurs (I'm one of them), some Reserve/Guard retirees would delay the start of their pension until after the next pay raise.

They'd lose a month or three of pension deposits and they'd eventually make it up on a higher base pay number in their pension calculation. (Assuming they lived long enough.) However today's High Three averages 36 months of base pay to start the pension calculation, so you have no benefit to delaying the start of your pension. Keep checking the new pay tables every year in case O-5 pay has any longevity raises past the current 22 years.

The actual numbers depend on the pay tables in effect when you're ages to determine the average of those 36 highest months, but using the 2018 pay tables puts the calculation in today's dollars. Depending on the dates you deployed, their duration, and their timing around the fiscal year, you may be eligible to start your pension three months earlier for every 90 days in the combat zone. Earlier versions of the law required all 90-day periods to be served in the same fiscal year. This system applies to anyone with a DIEMS of 8 September 1980 to present. Retired pay is calculated based on a figure derived from the average of the last 36 months of basic pay for the approved retired grade , and from the length of service prior to reaching age 60. In other words, it is the basic pay in effect when you were ages 58, 59, and 60.

The percentage of that figure (36-month average) you will receive is calculated by dividing your total points by 360 and multiplying that figure by 2.5 percent. Reserve members with 20 or more years to begin drawing retirement benefits before age 60 if they deploy for war or national emergency. For every 90 consecutive days spent mobilized, members of the reserves will see their start date for annuities reduced by three months. However, because this was based on a law passed in 2008, it only applies for deployment time served after Jan. 28, 2008.

Next, each year of active duty service is worth 2.5% toward your service percent multiplier. So the longer you stay on active duty, the higher your retirement pay. For example, a retiree with 20 years of service would receive 50% of their base pay (20 years x 2.5%). A retiree would receive 75% of their gross pay after 30 years of service (30 years x 2.5%). Basically, I want my ID card to still show the rank I reached even though I realize I'll receive retired pay based on the next lower rank at which I did meet TIG.

Another caveat to the 2008 NDAA is that it applies to the pension but not to Tricare. When you retire awaiting pay your health insurance will shift from Tricare Reserve Select to Tricare Reserve Retired. That's a complicated calculation but we can come up with an estimate and you can refine it. Since you're retired awaiting pay, you're also eligible to purchase Tricare Reserve Retired health insurance until your Tricare starts at age 60. TRR is not subsidized like Tricare Reserve Select so the TRR premiums are higher.

How To Calculate Time Cards In Military Time You might do better with employer health insurance or from the ACA health exchange, although you can continue to seek treatment from the VA for conditions that are related to your disability rating. I am currently serving on active duty in the Navy with 17 years and some change behind me. I was an Army reservists from July of 1992 until July of 1998. In those 6 years as a reservists I was active duty a total of 6 months and 26 days. Correct me if I am wrong, but should that active duty time should be added to my current base pay in the Navy. It should reflect on my Navy LES. Would this be a matter to present to DFAS?

BCNR fixed my record but I still have not seen any back pay. When you update your estimate, you'd project your latest point count at 50 points/year through 20 good years. Then you'd use today's pay tables for the highest O-4 or O-5 pay, and estimate its High Three average as 96% of that pay table's numbers. Put those numbers into the Reserve pension formula, and that would give you a pension estimate in today's dollars. As an example, for retirement purposes, 20 years is the minimum qualifying level, but many service members serve additional years. The Department of Defense uses a multi-step formula to compute retirement benefits pay, so there is no single accurate answer when it comes what the average reserve retirement pay is.

It was when someone gave me a time that was in the afternoon or evening that I had trouble. I knew I had to add or subtract 12 to convert military time to standard time, I just never knew which one was the correct option in that moment. Consequently, I would stand there in silence, furrowing my eyebrows, trying to make the conversion as quickly as I could so I didn't look like an idiot.

Military time clock calculators can be found online, in apps and on computer software systems. When looking at a time card, first determine the start and end times and convert these into military time. Then simply plug in the start times, break or lunch times, and end times for the day and the calculator will do the rest. If a military time clock calculator is not available, this also can be done manually by simply subtracting the start time from the end time. This will give the total hours worked for the day.

Use the Military Time calculator to convert military time, aka a 24 hour clock, to civilian time and back. Also, see current 12 hour clock and military time now. If he has a significant degree of disability then he'll receive a portion of his pension from the Veteran's Administration, and your divorce agreement may not cover that situation. If that happens then you'll get less than $1975/month.

He may be able to make changes to his SBP beneficiary, too, unless that's covered in the divorce agreement. It's possible that you'll be eligible for Tricare healthcare when he turns age 60, and Tricare For Life at age 65. And finally, you'll need to check whether it makes sense for you to eventually draw Social Security benefits based on your own earnings record or his. For now, I'd calculate your pension based on your total points and today's pay tables. I'd assume that your pension will keep pace with inflation until age 60. That assumption is unpredictable but it's a reasonable approximation.

Also means that DFAS might have to do a Tower Amendment verification. I don't think the Tower Amendment will affect you but I'll describe it in case someone mentions it. It requires DFAS to check the pay table increases against retiree COLAs for the years after you made E-9. The average time credited was approximately 30 days each summer. From the vocabulary used during your conversation with the Retirement Services section, it's possible that they misunderstood your question. "High Three" is a pension calculation, not a time in grade.

If your Date of Initial Entry into Military Service is before 8 September 1980 then your pension is calculated using the Final Pay system. That's pretty rare these days, and us remaining Final Pay dinosaurs who are still in uniform are either admirals/generals or Reserve/Guard members with very long breaks in service. Let me know if you have a DIEMS before that date, even for the Delayed Entry Program or by attending a service academy. I enlisted in the Navy in January 1980 and left active duty September 1997. I entered the reserve a few months later and completed my reserve time in November 2002.

Of all the retirement plans, the Final Pay system uses the simplest formula. You'll receive 2.5% of your final monthly basic pay for every year of service. For example, if you retire after 40 years of active service, then you can expect to receive 100% of your monthly base pay as your retirement pension.